https://frontline.news/post/new-world-bank-nominee-aims-to-spend-trillions-on-climate-change

by Yudi Sherman

Joe Biden’s pick for World Bank president this week said he aims to refocus the bank’s goal from alleviating world poverty to also “fighting climate change”.

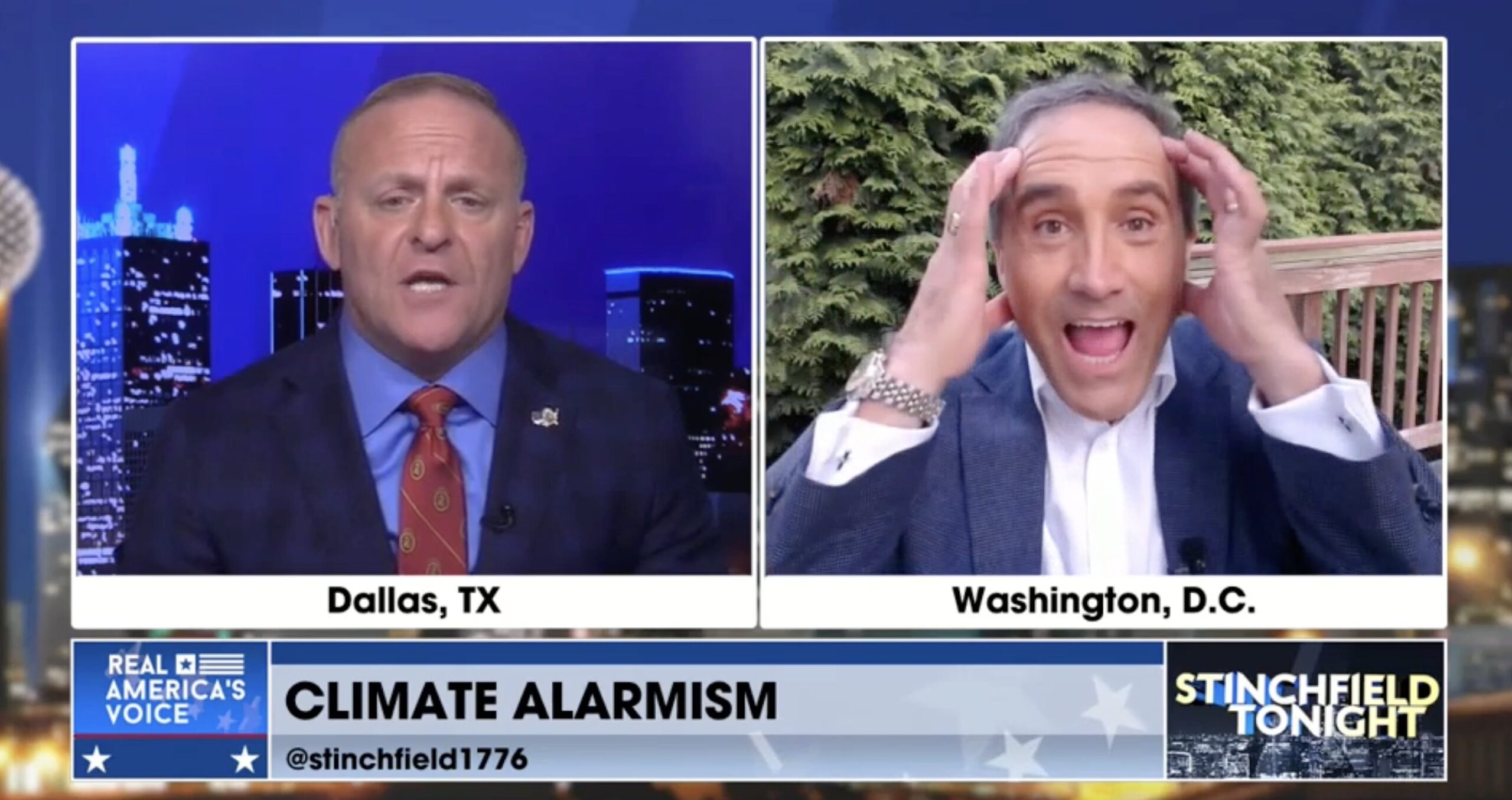

Former Mastercard CEO Ajay Banga was nominated by Biden last month to fill the seat of outgoing Trump appointee David Malpass, who is set to leave his post on June 30th. Malpass was forced to resign in February after failing to adequately display climate change alarmism. When he was asked by a journalist in September whether “manmade burning of fossil fuels is rapidly and dangerously warming the planet”, Malpass demurred that he is not a scientist, sparking intense backlash which included pressure from the Biden administration to resign.

Now Banga is set to take Malpass’ place, though he also has little experience with environmental science, and has signaled he will make climate change a priority for the World Bank, whose longstanding goal has been to reduce world poverty.

“I think it’s a fallacious argument that says, either-or,” Banga told Axios. “I have every intention of focusing the bank and its people on the idea that this is an intertwined challenge.”

“For climate change, it’s trillions of dollars a year. For inequality and poverty alleviation and development, it’s trillions a year,” he added. “You just have to get the private sector to be a constructive part of the solution.”

Banga’s zeal to recruit the private sector for climate change duty may serve as a warning sign for those already concerned with the climate autocracy exhibited by financial institutions.

Some economists and lawmakers have been warning that banks and financial institutions are becoming the “new legislatures” particularly when it comes to complying with environmental messianism.

“They can’t pass the Green New Deal in the United States Congress,” said New Hampshire State Rep. J.D. Bernardy, “but the banks can certainly implement it. The major banks, financial management firms, and insurance companies are de facto deciding how we will be able to live. They are becoming our new legislatures.”

“I think it is highly likely that within the next two years, you’re going to see financial institutions start to use a personalized social credit score of some kind to make decisions about things like your access to loans, your interest rate, or whether you’re eligible for insurance coverage,” said Heartland Institute Director Justin Haskins. “All the signs are pointing to that happening very soon,” he said.

American Legislative Exchange Council Chief Economist Jonathan Williams predicts that if enough progressive pressure is brought to bear on the financial system, it would mean “having people’s freedoms eroded without any legislation ever having to be passed, whether it’s companies with a radical take on ESG or FICO personal credit scores.”

Last year, for example, a Dutch bank executive advocated for a social credit system centered around people’s carbon emissions, which she called a “carbon wallet”. The idea, said Rabo Carbon Bank CEO Barbara Baarsma, is that a limit will be placed on citizens’ carbon emissions, which will be tracked via their transactions and purchases. People can then sell any unused “carbon credits” to others.

In Canada, a credit union now issues its customers Visa credit cards which track the carbon emissions resulting from their purchases.

Vancouver City Credit Union, known as Vancity, introduced the product last month as part of its “commitment to climate action.” Vancity partnered with climate technology company ecolytiq to develop the card, which not only tracks customers’ carbon emissions but also tells them how they can remedy their actions.

In Australia, a mobile app feature from Commonwealth Bank tracks the carbon footprints of its customers based on their transactions. The app then analyzes the customer’s carbon footprint, including how many trees were destroyed by the customer’s behavior. The customer is notified within the app and is offered the opportunity to pay to offset the harm they caused the environment.