The Ingraham Angle – Fox News Channel – Broadcast June 12, 2205

We used to mine 90% of our own rare earths—now we import 90%, mostly from China. Clinton-era regs and U.S. outsourcing handed Beijing control. They’re in the driver’s seat, and we’re dangerously dependent. This didn’t happen by accident. – Marc Morano pic.twitter.com/nscN9PbgkO

— Laura Ingraham (@IngrahamAngle) June 13, 2025

Background:

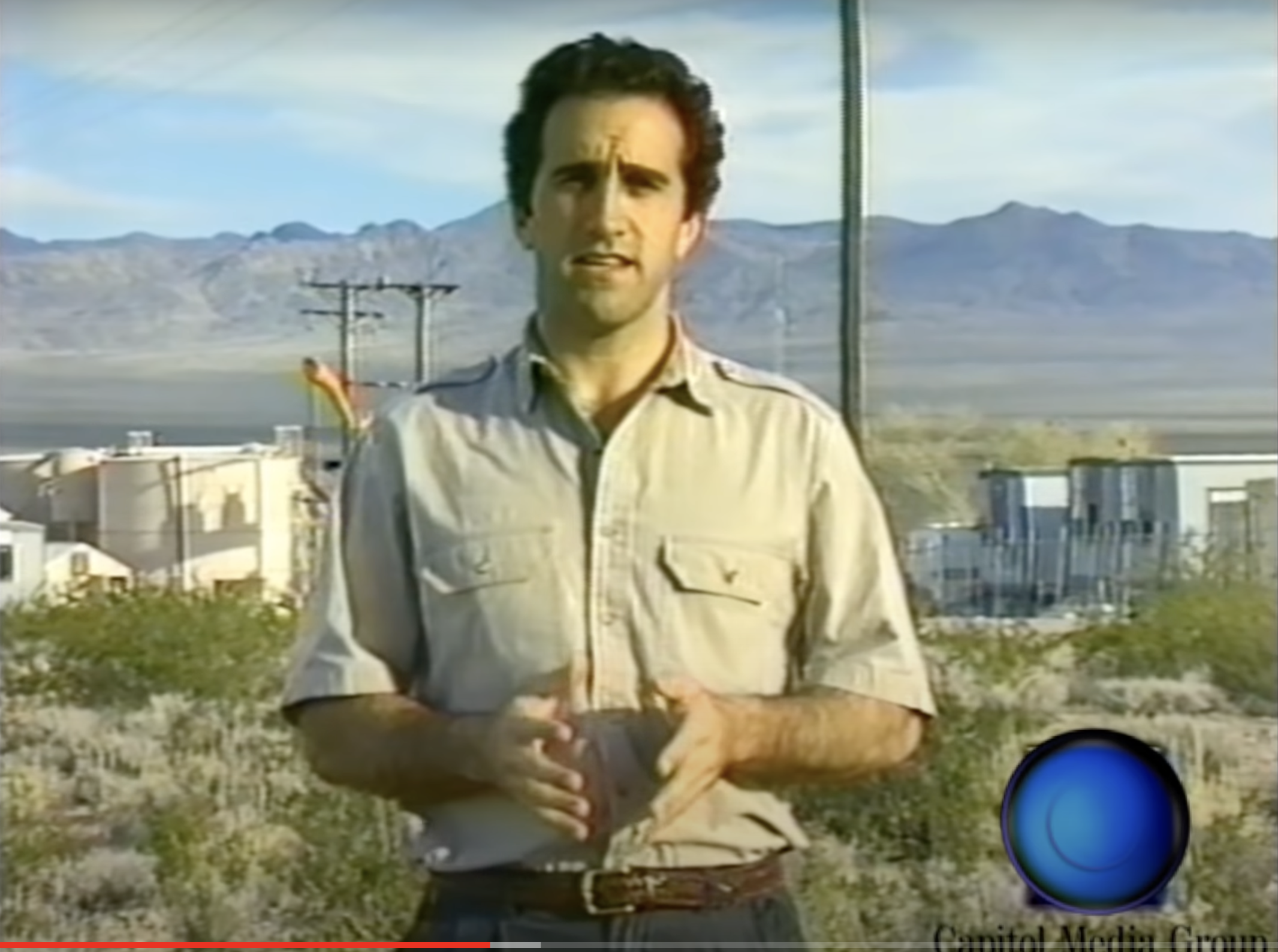

Flashback 1998: Morano has been covering rare earth mining since the 1990s. Watch the 1998 Marc Morano & Scott Wheeler documentary on how U.S. rare earth mining operations were shut down due to environmental regulations while China laughs.

Oringal 1998 broadcast of Desert Stormtroopers w/ Marc Morano & Scott Wheeler

Morano on Fox in June 2025: China has been faking green for so long. Meanwhile, China has double the CO2 emissions of the U.S. China has a monopoly on rare earths required for ‘green’ energy and EVs. China is laughing — not only all the way to the bank, but to energy and national security dominance.

#

Trump says rare earths deal ‘done’ with China – Trump said China had agreed to supply US companies with magnets and rare earth metals, while the US would walk back its threats to revoke visas of Chinese students. “Our deal with China is done, subject to final approval from President Xi and me,” Trump wrote on his media platform Truth Social. … The negotiations in London were triggered in part by US concerns that China was being too slow to release exports of its magnets and rare earth minerals, which are essential for manufacturing everything from smartphones to electric vehicles.

How the US Can Mine Its Own Critical Minerals — Without Digging New Holes- May 6, 2025 – Yuanzhi Tang, Professor of Biogeochemistry, Georgia Institute of Technology & Scott McWhorter, Distinguished Fellow in the Strategic Energy Institute, Georgia Institute of Technology

Excerpt: The U.S. depends heavily on imports for most critical materials. In 2024 the U.S. imported 80% of rare earth elements it used, 100% of gallium and natural graphite, and 48% to 76% of lithium, nickel and cobalt, to name a few. … Rising global demand, high import dependency and growing geopolitical tensions have made critical mineral supply an increasing national security concern − and one of the most urgent supply chain challenges of our time. … The U.S. currently has only two domestic rare earth mining locations: Georgia and California. In southeast Georgia, rare earths are being produced as a byproduct of heavy mineral sand mining, but the produced rare earth concentrates are shipped out of state and then abroad for refining into the materials used in renewable energy technologies and permanent magnets. The other location is in Mountain Pass, California, where hard rock mining extracts a rare earth carbonate mineral called bastnaesite. Yet again, much of the material is sent abroad for refining. As a result, the entire supply chain − from mining to final use in products − stretches across continents. … One of the fastest ways to increase U.S. rare earth production may not require digging new holes in the ground − but rather returning to old ones. … The Future of Waste Mining: This approach is part of a broader strategy known as “waste mining,” “urban mining” or “mining the anthropogenic cycle.” It involves the recovery of critical minerals from existing waste streams such as mine tailings, coal ash and industrial byproducts. It is also part of building a circular economy, where materials are reused and recycled rather than discarded.

#

Rare Earths Reserves: Top 8 Countries – Feb 5, 2025: China is the top producer of rare earths and also holds the largest rare earths reserves.

Top rare earth reserves by country:

1. China

Rare earths reserves: 44 million metric tons2. Brazil

Rare earths reserves: 21 million metric tons3. India

Rare earths reserves: 6.9 million metric tons

4. Australia

Rare earths reserves: 5.7 million metric tons

5. Russia

Rare earths reserves: 3.8 million metric tons

6. Vietnam

Rare earths reserves: 3.5 million metric tons

7. United States

Rare earths reserves: 1.9 million metric tons

8. Greenland

Rare earths reserves: 1.5 million metric tons

#

Once a global leader in the production, research, development, and fabrication of REEs and REE magnets throughout the 1950s–1990s, the US’s domestic technology was slowly transferred to China so as to outsource the environmental costs of natural resource exploitation and to take advantage of cheaper Chinese labor.

While upstream ore processing technology was being transferred to China, downstream REE magnet manufacturing operations were also relocated. In 1995, General Motors sold Magnequench to an investment company called Sextant Group—a front for two Chinese companies (San Huan New Material and China National Nonferrous Metals Import and Export Company) that had been pushing General Motors to sell Magnequench since 1993 (Tkacik, 2008; Meyer, 2015; Case, 2010; Machacek and Fold, 2014). The company soon had a new owner, Zhang Hong—son-in-law of the former Chinese leader Deng Xiaoping2—who later became the director of the Research and Development Bureau of the Chinese Academy of Sciences (Li, 2001). Mr. Zhang’s desire to acquire Magenquench was reportedly informed by the Chinese government’s 863 Program, or State High-Tech Development Plan, which intended to stimulate the development of advanced technologies for military applications (Wu, 2000).

While the US was becoming more dependent on China for cheap REE commodities, Beijing started to implement a REE quota system to limit their export.

https://muse.jhu.edu/pub/255/oa_monograph/chapter/2264076/pdf

Excerpt: One particularly vivid illustration is the key role played by Edward Nixon in transferring various aspects of the beneficiation process from the Mountain Pass mine in Southern California to China, beginning in the 1980s. Edward Nixon played an interesting role in the development of US environmental policy as well as the relocation of the US rare earth industry to China. A graduate of Duke University’s geological sciences program, he reportedly persuaded his brother, President Richard Nixon, to establish the Environmental Protection Agency (EPA). He was active in the private sector in the late 1960s and early 1970s, occupying leadership roles in consulting firms that claimed to provide environment-related services, though information about their precise operations is difficult to find.

The record of the younger Nixon’s activities has been carefully buried in English language archives, but sales receipts and other archival materials held in China help uncover some of this history. In 1982, the well-established Mountain Pass mine in Southern California had just completed a US$15 million separation plant to allow for a 35 percent production increase. At the time, the mine was responsible for 70 percent of the annual global production of rare earth oxides (Goldman 2014). As the EPA began more regularly monitoring environmental practices in US mines in the late 1970s and early 1980s (EPA 2014), this Unocal-operated mine was subjected to increased scrutiny. In the early 1980s, Nixon reportedly approached mining executives with a proposal to subcontract some of the beneficiation processes to China in order to reduce environmental liabilities in California and to save costs. It was more cost-effective to ship tons of minimally processed ore concentrates to China rather than ensure environmentally sound practices on US soil. For the brief period between 2012 and 2015 that production at Mountain Pass resumed, this continued to be the case, as export data at the Port of Oakland indicates (PMSA- WIL 2013). But the subcontracting went beyond this, driven by the imperative to move ever-greater portions of production offshore in order to reduce costs and increase profits. Over the course of the 1980s, Nixon’s firm was one of several that facilitated the transfer of magnet production to China, setting up joint ventures with Chinese partners in order to produce cheaper rare earth magnets. These relatively early post-reform joint ventures also provided technology transfer from international firms to Chinese firms. Technology transfer— combined with the mid-century industrial and scientific foundation laid by Sino- Soviet investment and ongoing state support— contributed to the steady growth of China’s rare earth industry. Edward Nixon subsequently founded Great Circle Resources, Inc., to help downstream industries in the West purchase refined rare earth oxides from China. Thus, Nixon facilitated the transfer of production and technology to China and facilitated the resale of cheaper commodities to US firms.

#

Biden’s Signature Climate Bill Has Been A Boon To China’s Battery Market- February 20, 2024

Apr 18, 2025 — The US has a single rare earths mine. Chinese export limits are energizing a push for more. AP News. – China holds power over the market – China has tremendous power over the rare earths market. The country has the biggest mines, producing 270,000 metric tons (297,624 tons) of minerals last year compared to the 45,000 tons (40,823 metric tons) mined in the U.S. China supplies nearly 90% of the world’s rare earths because it also is home to most of the processing capacity.

The restrictions Beijing put in place on April 4 require Chinese exporters of seven heavy rare earths and some magnets to obtain special licenses. The retaliatory controls reinforced what the Trump administration and manufacturers see as a dire need to build additional U.S. mines and reduce the nation’s dependence on China.

Trump has tried, so far unsuccessfully, to strong-arm Greenland and Ukraine into providing more of their rare earths and other critical materials to the United States.

#

Reimagining US rare earth production: Domestic failures and the decline of US rare earth production dominance – Lessons learned and recommendations

#

https://www.sciencedirect.com/science/article/pii/S030142072300733X

Today, there is an imbalance of global rare-earth elements (REEs) supply chain.

China has a global monopoly on the production (70%) and processing (90%) of REEs.

China’s dominance has become a focal point in great power competition with the US.

Decline of the US supply chain for REEs is analyzed in view of domestic factors.

Strategic cooperation between China and the US is recommended.

#

Update July 2025: Years Opens In Wyoming – ‘Will extract rare earth elements directly from coal’