BY: TRISTAN JUSTICE

The U.S. Securities and Exchange Commission is relying on a network of foreign investors to present an illusion of broad support for the agency’s proposed climate disclosure rule, which threatens to increase structural risks to the American economy.

In March, the trade agency outlined new regulations requiring firms to report their estimated energy emissions. While the SEC technically only has jurisdiction over publicly traded companies, the broad nature of the agency’s proposal aims to coerce private businesses into carbon calculations that track the behavior of their customers. Firms that fail to comply with government standards are subject to fines and lawsuits.

“By requiring the corporations the SEC regulates to make scope 2 emissions disclosures, those corporations will be forced to require the businesses they source from to calculate and disclose their emissions or stop doing business with them,” Hild told The Federalist. “So even if a business is private (not publicly traded) but their customers are public companies, then the SEC will have effectively forced them to participate in the disclosures scheme.”

According to an analysis of the SEC’s proposal from the Western Energy Alliance, a coalition of predominantly small independent oil and gas producers, more than 80 percent of asset managers cited by the agency as supportive of the new regulations are foreign. Just 7 percent of American asset managers support the disclosure rules.

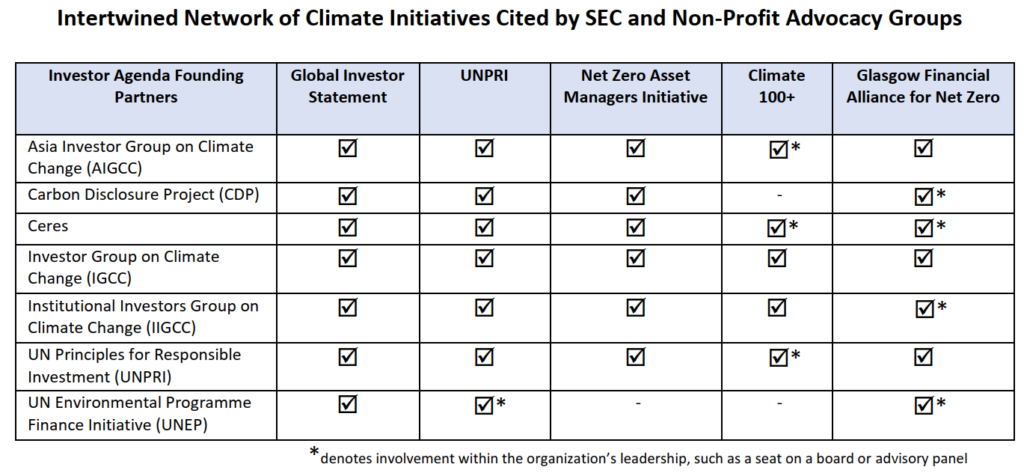

The white paper from the Alliance published in June outlines how activist investors are masquerading as representative of majority sentiment on Wall Street despite just a handful of firms forming multiple coalitions. According to the report, seven major climate change advocacy organizations cited by SEC as behind the agency on mandated disclosure include the same investor coalition groups working in close collaboration. It’s as if the same 50 members of Congress formed 100 different caucuses that pledged support to particular legislation to show proof of consensus.

“These groups are so intertwined that it is not at all clear they represent anything other than a minority of investors advancing a particular policy agenda,” the Alliance report reads. “Across those seven climate initiatives and the global network of non-profit organizations that support them, only 19 percent are American. More than half are European.”

Among the groups behind the SEC climate disclosure is Climate Action 100+, a coalition of investors pushing to eliminate highly efficient fossil fuels through public and private policy. Earlier this month, House Republicans on Capitol Hill launched an antitrust probe into the group, where they described Climate Action 100+ as a “cartel” to “ensure the world’s largest corporate greenhouse gas emitters take… action on climate change.’”

The Alliance white paper also highlights Russian influence at the center of the SEC’s proposed rule via an endorsement from the Sea Change Foundation. In 2015, the Environmental Policy Alliance described the Sea Change Foundation as “a conduit for funneling Russian government money to U.S. environmental groups in order to undermine American natural gas and oil production to Russia’s benefit.”