https://www.zerohedge.com/energy/dallas-fed-surging-costs-hamper-us-shale-growth

BY TYLER DURDEN

Authored by Tsvetana Paraskova via OilPrice.com,

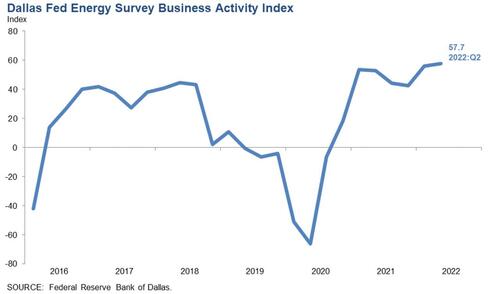

The business activity index in the energy firms operating in Texas, northern Louisiana, and southern New Mexico jumped in the second quarter to the highest level in six years, but costs continue to escalate and supply chain delays are worsening, the Dallas Fed Energy Survey showed on Thursday.

Activity in the oil and gas sector in the most prolific U.S. shale basin, the Permian, expanded at a robust pace in the second quarter, with the business activity index—the survey’s broadest measure of conditions facing energy firms—up from 56.0 in the first quarter to 57.7, registering its highest reading in the survey’s six-year history, the Dallas Fed said.

For a sixth quarter in a row, costs have risen this quarter, according to the survey of oil and gas executives at 85 exploration and production firms and 52 oilfield services firms.

The index for input costs at the oilfield services companies jumped to a record high, and none of those firms responding in the survey reported lower costs.

Delivery times for materials and equipment for the industry are rising, with many executives reporting significant delays.

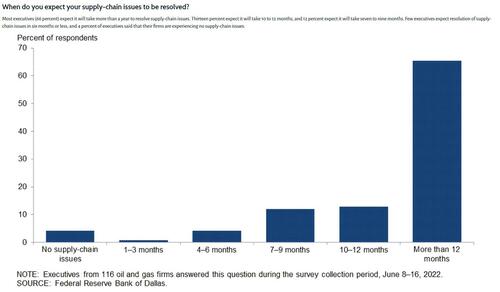

Nearly half of the executives – 47 percent – said supply-chain issues have a “significantly negative” impact on their firms, and another 47 percent see slightly negative impact. Just 6 percent of executives said their firms are experiencing no supply-chain issues or impacts.

Moreover, most executives – or 66 percent – expect it will take more than a year to resolve supply-chain issues.

In comments to the survey, an E&P executive said:

“We are experiencing significant delays in obtaining materials and services, and costs are substantially increasing. We will shortly be ceasing investment in any new operations owing to the combination of rising costs, supply-chain slowness and our view that a recession is coming that will drop oil and natural gas prices significantly.”

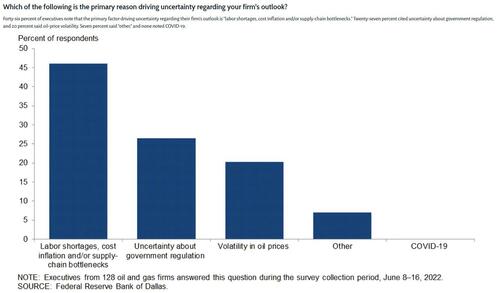

“Huge service cost increases, regulatory uncertainty and mixed messages from Washington are keeping me on the sidelines,” another executive noted.

One executive at an oilfield service firm commented: “The supply chain seems stretched to the max in the Permian Basin. There really is not much ability to increase drilling activity.”