Has renewable energy reduced our dependence on natural gas?

By Paul Homewood

Has renewable energy reduced our dependence on natural gas?

It is a question often posed lately, with the corollary that if we had built more renewable capacity we would now be much better off and less at the mercy of high gas prices.

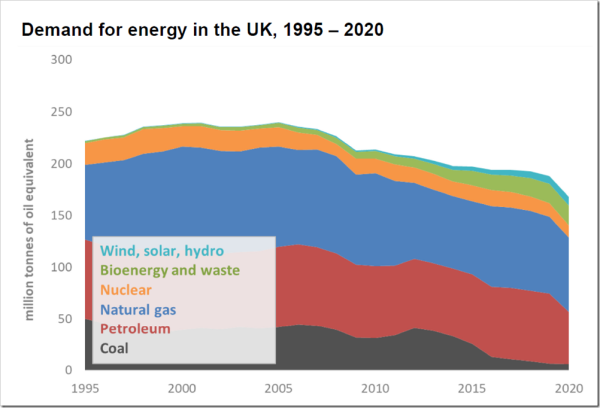

The graph below from the BEIS shows that the increase in renewable energy has been tiny in the last decade, and consequently has had little effect on gas consumption.

While total energy consumption has declined, most of this has impacted coal use.

https://www.gov.uk/government/statistics/digest-of-uk-energy-statistics-dukes-2021

In fact in terms of electricity, the share of gas generation has risen from 29% to 44% between 2015 and 2019, suggesting that intermittent wind and solar power have increased the reliance on gas, rather than reducing it.

As for being “better off”, we need to take account of the cost of subsidies paid out over the years for renewables already.

Let us suppose, for instance, that we had double the wind capacity we have now. We currently have 25 GW of wind power, split 14 GW for onshore and 11 GW offshore. Let us assume that we instead had 50 GW, split 28 GW onshore and 22 GW offshore.

Onshore wind is mainly subsidised via ROCs, at an effective rate of £55/MWh. The extra 14 GW of new build would typically generate 35 TWh, meaning an annual subsidy of £1.9 billion.

An extra 11 GW of offshore would generate about 41 TWh. Average CfD prices for offshore wind installed in the last few years are around £140/MWh. Up to 2020, this would mean a subsidy of about £4.1 billion a year.

In other words, totalling on and offshore, an extra £6.0 billion would have been paid out a year. Supposing we had added this extra capacity evenly over the last ten years, that extra subsidy would have amounted to £30 billion. This of course excludes indirect subsidies, such as grid balancing costs.

And how much would we be saving now by avoiding expensive gas? Not as much as you think, I suspect.

CfD offshore generators are typically currently returning £60/MWh to consumers, which works out at £2.5 billion a year. However, onshore operators would still be getting the full market price of around £200/MWh in addition to their ROCs. Consumers therefore would be continue to be £1.9 billion worse off as a result.

Overall the CfDs and ROCs together would leave consumers just £600 million better off. At this rate, it would take fifty years to get back that £30 billion we have already stumped up!!

By the Way!

I’ve been meaning to publish this chart I came across a while back. It compares wholesale electricity prices across Europe:

There are various conspiracy theories going round about why our energy prices in the UK are so high. As the chart shows, however, wholesale prices are very similar across most of Europe, clearly indicating that this is an international problem, and not something cooked up by the wicked energy companies.

There are some interesting exceptions.

Norway, Finland and Sweden are all heavily reliant on hydro and/or nuclear, and are therefore relatively unaffected by swings in gas prices. As such, they appear to be cut off from the EU system.

Similarly with Bulgaria, where electricity prices are half those of neighbouring Romania.

Remember that these are wholesale prices. Retail prices are of course affected by all of the subsidies paid out to renewables, along with grid balancing costs and so on.