https://www.cbsnews.com/news/climate-change-housing-foreclosures-credit-losses-first-street/

Extreme weather linked to climate change could spell financial ruin for many American homeowners and lead to billions in losses for lenders, a new study finds.

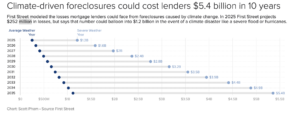

First Street, a research firm that studies the impact of climate change, projects in an analysis released Monday that foreclosures across the U.S. caused by flooding, wind and other weather-related incidents could soar 380% over the next 10 years. By 2035, climate-driven events could account for up to 30% of all foreclosures by 2035, up from roughly 7% this year.

Low- to moderate-income households are particularly vulnerable to the effect of severe weather on their homes, First Street noted. Much of Americans’ wealth is tied up in the value of their properties.

A cascade of foreclosures, driven by the mounting costs of repairs and rising insurance premiums stemming from extreme weather, wouldn’t only hurt homeowners. First Street estimates lenders will lose $1.2 billion a year in 2025 — and up to $5.4 billion in 10 years — as they are forced to absorb the cost of mortgage defaults.

Such losses represent the “hidden risks” of climate change that lenders often fail to account for in their underwriting practices, Jeremy Porter, head of climate implications at First Street, told CBS MoneyWatch. Lenders consider factors including a borrower’s income, debt and credit score in issuing mortgages, but not the potential impact of extreme weather on a property or how it could raise premiums.

First Street also looked at how indirect factors, like rising insurance premiums, are already shaping foreclosure trends. For every 1% increase in insurance costs, the firm projects a roughly 1% increase in the foreclosure rate nationwide.

The findings comes as insurers are jacking up the cost of homeowners policies and in some cases exiting markets around the U.S. altogether, leading to spottier coverage in disaster-prone areas like California. That could leave more individual homeowners on the hook for damage from extreme weather.

First Street said integrating climate risk into loan assessments could help lenders – and homeowners – be better prepared for weather-related disasters. But it could also tighten lending conditions, Porter said, putting potential homebuyers at a disadvantage.

“It’s going to increase the price of homes. It’s going to increase interest rates,” he said.