Britons face biggest drop in living standards since records began

The Times, February 4, 2022

Households will experience the biggest fall in their living standards since records began as they face soaring inflation, tax increases and rising energy bills.

In a bleak assessment of the year ahead, the Bank of England warned people that take-home pay would fall by five times the amount it did during the financial crisis of 2008. It will be the worst hit to real incomes since comparable records began in 1990.

Ofgem, the energy regulator, announced yesterday that the price cap on energy bills for 22 million households would rise by 54 per cent from April. For most households the increase will be £693 to £1,971 a year, whereas the costs for 4.5 million with prepayment meters will rise by £708 to £2,017 on average.

The chancellor responded with a £9 billion package of loans and council tax rebates to take the “sting” out of the price increase but admitted that bills would rise by £350 for most households this April. He said that Britain would have to get used to higher energy prices in the long term.

The Bank of England confirmed that interest rates would rise from 0.25 per cent to 0.5 per cent, which will lead to higher mortgage rates. Some on the monetary policy committee, the body that sets interest rates, pushed for an increase to 0.75 per cent. The Bank also warned that the combination of higher energy prices and the rising cost of goods would lead to a 2 per cent drop in households’ net incomes after inflation.

Conservative MPs criticised Sunak over plans to increase national insurance contributions in April by 1.25 percentage points both for employers and employees, with one branding him a socialist. The chancellor said that the government could not keep energy bills “artificially low” in the face of soaring wholesale gas prices, adding that to do so would be “dishonest”.

#

Net Zero Samizdat

4 February 2022

The Daily Telegraph, 4 February 2022

Senior Cabinet ministers believe there should be a rethink of the Government’s net zero plans as the country faces the biggest cost of living crisis in a generation, The Telegraph can disclose.

A number of ministers have expressed concern that the pace of the planned switch to renewable energy is too fast and is increasing costs for consumers. They believe Britain should use more of its own gas in the short-term.

On Thursday, it was announced that energy bills will rise by almost £700 from April – an increase of more than 50 per cent and the largest on record.

Rishi Sunak, the Chancellor, announced a £9billion bailout, which will see rebates of £200 for all bills and a £150 council tax cut for those in less expensive homes, to help households cope with the unprecedented rise.

However, a controversial green energy levy, which will add £153 a year to the average bill from April, has been kept.

The Bank of England also raised interest rates to 0.5 per cent, warning that inflation would hit seven per cent by April amid growing fears over a cost of living crisis.

Andrew Bailey, the Bank’s Governor, said the country was facing the worst crunch to household incomes since its records began in 1990. However, he also urged workers not to ask for big pay rises or they would risk making inflation worse.

Wage growth slowed to just 4.2 per cent at the end of last year, meaning workers will require an 8.7 per cent pay rise for their salaries to keep pace with current levels of inflation.

Cabinet ministers are increasingly uneasy about Downing Street’s focus on its net zero target and have warned that the cost of living crisis should be given more priority in the coming years.

One said the UK “should not be running towards net zero so aggressively”, describing the 2050 pledge as one of the “most aggressive targets in the world”.

“We’ve stigmatised gas, and that’s wrong,” the minister said. “Gas has to be part of the answer.”

Another Cabinet minister told The Telegraph: “The priority should be the cost of living – 2050 is a long way away, and our own gas is a valuable transition fuel in the meantime.” That view is understood to be shared by at least another two Cabinet ministers.

Mr Sunak indicated that he may share these concerns, and highlighted that North Sea gas “plays an important part of our transition to net zero”.

He told a Downing Street press conference: “I want to make sure that people acknowledge that we should also exploit our domestic resources. We have resources in the North Sea, and we want to encourage investment in that because we’re going to need natural gas as part of our transition to getting to net zero.

“And in the process of getting from here to there, if we can get investment in the North Sea that supports British jobs, that’s a good thing. So that has to be part of the mix as well.”

The Telegraph can reveal that Mr Sunak has asked Kwasi Kwarteng, the Business Secretary, to fast-track new licences for North Sea gas exploration.

A source close to Mr Kwarteng said he believed the North Sea oil and gas industry should be protected to prevent imported energy becoming a “geopolitical weapon” that can be used against Britain.

“You cannot turn the taps off overnight, because restricting North Sea production doesn’t restrict demand,” a government source added.

This week, the EU announced that it classed gas as a “bridge” to its own net zero target, along with nuclear power.

Mr Sunak said it was “not sustainable” to keep energy bills “artificially low” amid rising prices on global markets, fuelled by concern about Russian aggression on the Ukrainian border.

“Higher energy prices are something that we’re going to have to adjust to in common with other countries around the world and it would be wrong to pretend otherwise,” he said.

3) Editorial: Britain’s energy crisis is self-inflicted

The Daily Telegraph, 4 February 2022

It has been a 30-year shambles, with successive governments failing to exploit shale gas and nuclear energy

On what has been dubbed Black Thursday, the consequences of incessant governmental interference in the energy market were mercilessly exposed when average household gas and electricity bills rose by more than 50 per cent. The price cap first proposed by Labour and introduced by Theresa May’s administration, will be raised in April to take account of the rise in world gas prices.

Rishi Sunak, the Chancellor, announced a range of measures costing £9 billion to help cushion the financial blow which he blamed on forces beyond the control of the Government. But while he is right to say wholesale gas prices are not set by ministers, domestic policy is – and what we are witnessing is the result of three decades of abysmal failure to develop a coherent energy strategy.

Nor is it good enough to blame Russia for “weaponising” its gas supplies, even if that is true. Had this country invested over the years in new nuclear plants and shale it would be in a far better position to withstand such shocks.

All parties are to blame for this parlous state of affairs.

The Conservatives abandoned the nuclear programme proposed by the Thatcher government in a “dash for gas”; Labour intervened in the market on environmental grounds, loading costs on to energy production that were carried forward by the Coalition government. Legislation supporting this approach was backed by most Tory MPs 12 years ago and has been reinforced by the current Government’s carbon reduction targets. Around 20 per cent of energy bills is now accounted for by social and green levies.

The big political question is whether the country is prepared to pay for net zero now that people can see the implications of a policy that will do nothing to combat global climate change for as long as the world’s biggest CO2 producers refuse to change their own practices.

Moreover, the energy price rise is feeding inflation, which rose to 5.2 per cent last month and is expected to peak at 7 per cent in the spring, prompting the Bank of England to raise interest rates to 0.5 per cent.

Yet Mr Sunak’s package will go only some way to ameliorate the financial impact. For most households it is worth £350, whereas average energy bills are going up by £700. It will be paid by way of a discount on energy bills in October and a council tax rebate. At the same time, National Insurance Contributions are about to rise by 1.25 per cent for employees and employers, while tax thresholds are being frozen. As the Tory MP Peter Bone asked in the Commons yesterday, in what way is it a Conservative approach to raise taxes and then give the money back to selected groups through subsidies and handouts?

The Chancellor ruled out removing VAT on energy, which the UK is now in a position to do since leaving the EU. It would cut £250 from the average bill overnight but Mr Sunak said it would disproportionately benefit the better-off.

Such dramatic interventionism would be unnecessary had successive governments not handled energy policy so badly. It has been a 30-year shambles, the ramifications of which will be felt for decades to come – and mistakes continue to be made. Why, for instance, are we not following the EU in designating natural gas as a “sustainable” energy source to boost investment in its use as a transition to low carbon?

The craven failure to exploit vast quantities of shale; the neglect of the nuclear programme; the deliberate refusal to give the go-ahead to continued oil and gas exploration in the North Sea while importing both from abroad; all have conspired to create the mess in which the Government now finds itself. Loaning billions to energy companies so that they do not pass on the full costs to their customers but recoup them when wholesale prices fall assumes they will fall. If they don’t, the taxpayer is liable for the cost, so will pay in the end anyway.

Ministers invite us to believe that they are grappling with circumstances over which they have no control and yet Government policies are at the root of our problems, whether it be the stampede to net zero, the Climate Change Act, the energy price cap, the botched regulation of suppliers or the failure to take critical decisions when they were needed. This is not a crisis visited upon us by outside forces. It is home grown. The fault and the solution lies with our own politicians.

4) Editorial: Self-inflicted misery of our energy insanity

Daily Mail, 4 February 2022

It was the blackest of days for Britain. Yesterday, the fallout from a near two-year global economic shutdown began to bite – and agonisingly hard.

There can be no sugar-coating the bad news: Millions must steel themselves for immensely difficult times ahead.

And as the great purge of Downing Street advisers started following Partygate, didn’t the grave plight facing almost every household make the Left’s fixation with cake and drinks appear very trivial?

For the Bank of England governor had warned the biggest fall in living standards since records began in 1990 was looming.

On what was fittingly dubbed Black Thursday, the gloomy news came thick and fast. It’s hard to know where to start.

Typical gas and electricity bills will skyrocket by a wince-inducing £700.

Inflation is forecast to hit 7.4 per cent – a level not seen for a generation. Food, fuel and transport prices are spiralling.

To fight this fire, the Bank put up interest rates – a painful blow for many mortgage holders and home-buyers. And all this before crippling tax increases kick in.

For ordinary families, this feels less a cost of living crisis, and more a brutal mugging.

To his credit, Rishi Sunak announced emergency support to soothe the pain.

Every household will receive up to £350 including rebates to help with bills.

Like all chancellors, though, he deployed smoke and mirrors. Not all the money will arrive in time for bills landing on doormats in April and most must be repaid.

But wouldn’t a better way – a more Conservative one – of helping struggling families be to scrap the unpopular national insurance hike or axe VAT and ludicrous ‘green’ subsidies on domestic fuel? That would leave more money in their pockets.

It’s true that the trigger for this crisis has been the sudden surge in gas demand as the global economy reopens. But by bungling its energy policy, Britain has left itself especially vulnerable to shocks.

Successive governments ignored warnings about the insanity of having no long-term strategy to safeguard energy security. Now the chickens have come home to roost.

How unnecessary this is. For Britain sits on an energy goldmine. We have vast unexploited reserves of oil, gas and shale. And we had the chance to expand nuclear power.

But hypnotised by the apocalyptic alarmism of eco-activists, our politicians have pursued an aggressive green agenda, shunning these abundant power sources.

It means we are left at the mercy of unreliable renewables and importing high-priced energy to stop the lights going out.

While Boris Johnson burnishes his credentials by recklessly committing to go further, faster, than anyone else to net zero – causing great suffering to consumers and businesses – China continues building coal-fired power stations, adding a UK’s-worth of carbon dioxide emissions every year.

The Mail believes passionately in the obligation to safeguard the planet for future generations. But energy security and economic growth should be the embattled PM’s number-one concern.

Yesterday, hardship-threatened Britons saw with their own eyes the miserable consequence of him treating those priorities as afterthoughts.

Daily Mail, 4 February 2022

Ross Clark analyses the state of Britain’s energy reserves as we face soaring bills

If Ofgem’s decision yesterday to hike domestic energy bills from April by almost £700 confirmed one thing for us, it should be that now, more than ever, we must rapidly work towards energy security.

Indeed, it doesn’t have to be this way. As British households worry how they are going to keep warm, Americans remain as happy as Larry.

In the US electricity prices currently average $0.15 (11.2p) per kWh (kilowatt-hour) – little more than half the average of $0.28 (20.6p) per kWh in Britain. And that is before you account for Ofgem’s price rise.

So why is it so expensive over here?

The answer is prices are kept affordable for Americans because of an energy policy which prioritises self-sufficiency.

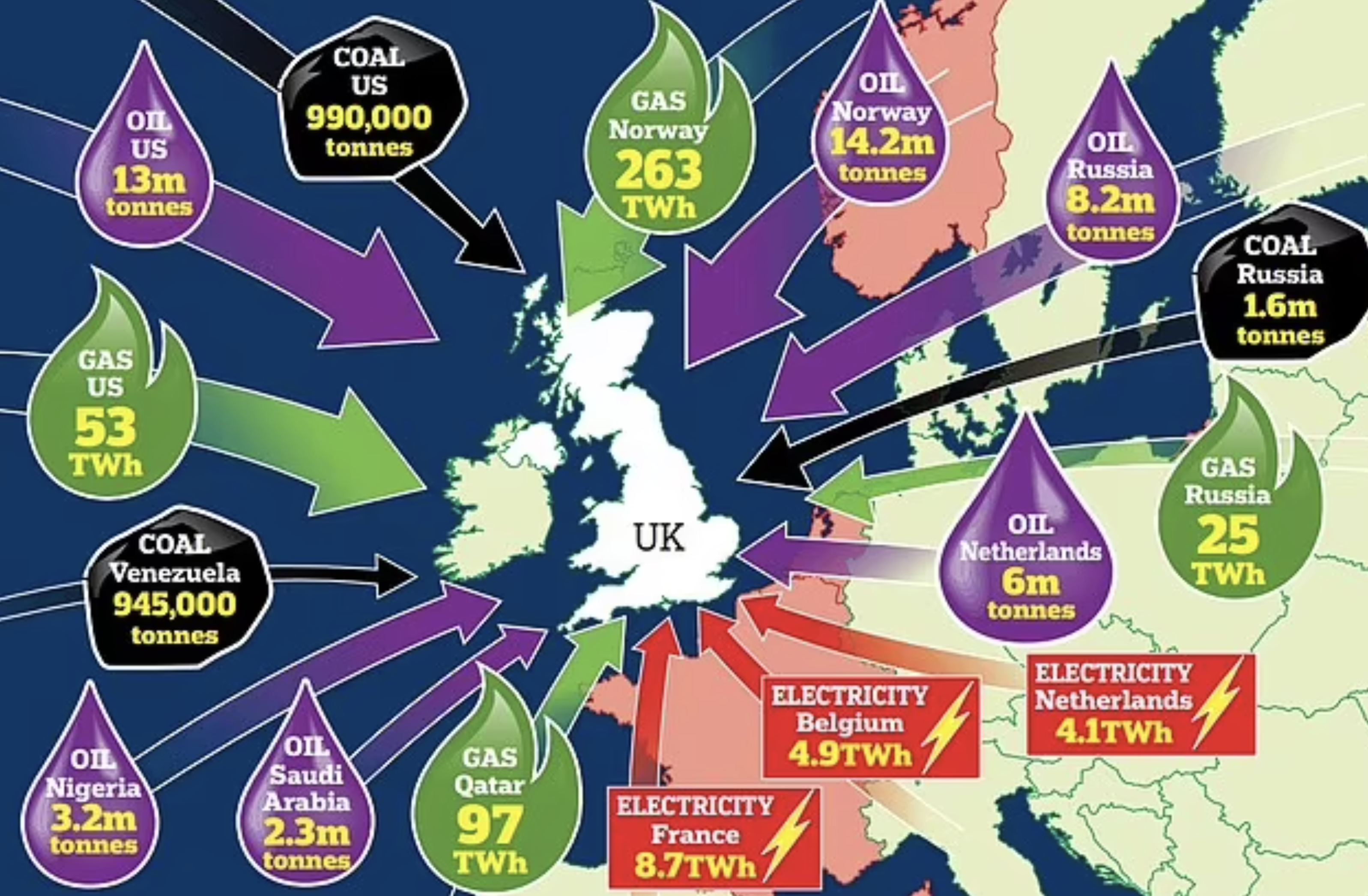

Graphic shows where the United Kingdom imports its energy from. The UK and Europe now find themselves trapped in a perilous price hike

By exploiting vast shale gas reserves, America escapes the whims of international markets. Europe and the UK, on the other hand, now find themselves trapped in a perilous price hike.

For a variety of reasons, international wholesale prices are soaring – not least because of artificially implemented pressure from President Vladimir Putin, who is said to be inflating the price of gas coming out of Russia.

And yet, this mess makes little sense when Britain is sitting on ample gas, oil and coal reserves.

Where did it all go wrong?

Britain’s energy problems can largely be traced back to then Energy Secretary Ed Miliband’s Climate Change Act of 2008, which legally committed Britain to cut carbon emissions by 80 per cent by 2050.

In 2019, then Prime Minister Theresa May upped that target to going net-zero (fully carbon-neutral) by 2050. Boris Johnson has maintained that goal.

Yet as we continue to close coal plants, switch to electric and ramp up inefficient renewables we place ourselves even more in the clutches of those we import from.

Here, we provide an audit of all the energy we don’t need to be importing – and reveals the huge British reserves we should be using to avoid an energy crisis like this.

Where we import our energy from

Coal: The Government has pledged to phase out the last coal-fired power station by 2024, yet for now we are still heavily dependent on coal when wind and solar power fail.

In 2020, 45 per cent of that coal was imported – in spite of Britain sitting on several hundred years’ worth of reserves.

We imported 4.5million tonnes of coal in 2020. (One tonne is enough to power one home for about 100 days). Some 2.4million tonnes of that was steam coal (used in power stations) and 2.1million tonnes was coking coal (used for steel production).

It should be at least mildly concerning that Russia was the single biggest source of our imports, shipping 1.62million tonnes to us. The US sent us 990,000 tonnes and Venezuela 945,000 tonnes.

Oil: Twenty years ago Britain was self-sufficient in oil. No longer. We produced 49million tonnes of oil in 2020 but had to import 63.7million tonnes. (One tonne is enough to power 500 homes for a day).

Again, this is despite huge reserves under the seas surrounding Britain. Our biggest sources of oil were Norway (14.2million tonnes), the US (13million tonnes), Russia (8.2million tonnes) and the Netherlands (6million tonnes).

Gas: In 2020, Britain produced 439 TWh (terawatt hours) worth of gas but imported 478 TWh. For context, about 30 TWh would provide every home in London with electricity for a year.

More than half the imported gas came to us via pipelines from Europe – with Norway sending the most at 263 TWh. We also imported 97TWh from Qatar, 53TWh from the US and 25TWh from Russia.

The Government likes to try to reassure us this means very little comes from Russia, but that’s hardly the case.

Britain lies at the western end of a European gas grid, powered in large part by Russian gas pipes. If Russian gas were to be withheld at the eastern end we couldn’t continue drawing-off gas from Europe.

Electricity: Britain’s generating capacity actually fell by 2.7 per cent in 2020 –– in spite of all our wind and solar farms. And so, Britain imports large quantities of electricity from European power stations, via undersea cables.

We also export electricity (the cables automatically work in both directions and the energy flow shifts to deal with demand).

But on the whole we are a net importer. In 2020, 8.7TWh came from France, 4.1TWh from the Netherlands and 4.9TWh from Belgium.

Energy reserves Britain chooses not to use

Oil and gas: The Oil and Gas Authority says ‘proven and probable’ reserves of oil and gas under the North Sea extend to the equivalent of 5.2billion barrels of oil – about 70 per cent is oil and 30 per cent gas. That would be enough to sustain UK production at current levels for 20 years.

Shale: There is a wealth of shale gas sitting beneath our feet. We could have started exploiting this years ago, but the Government wilted in the face of environmental protesters and a number of minor tremors. Since then most of the propaganda against fracking has proven baseless.

Yet the industry remains in abeyance. According to a 2013 estimate, there could be over 2,000trillion cubic feet, while an estimate from 2019 put viable reserves closer to 140trillion cubic feet. Even that lower estimate would keep Britain going for 47 years.

Coal: No one wants to go back to the days when Britain ran on coal. But, on the other hand, we are still laughably reliant on coal imports.

This surely makes little economic sense – and hardly means we can call ourselves ‘green’. According to the trade body Euracoal there are at least 3.9billion tonnes of coal reserves left in Britain – enough for 500 years of energy.

Nuclear: As for nuclear, the industry is wasting away – in spite of the construction of the long-delayed Hinkley Point C plant in Somerset.

There are now just six working nuclear power stations left in Britain. All are scheduled to close by 2035.

Nuclear represents a huge potential energy source. It is extremely efficient and has a very low carbon footprint. Small modular reactors are a particularly exciting emerging market that could be used for mini-plants across the UK.

6) Boris Bungles the British Economy

Editorial, The Wall Street Journal, 4 February 2022

If Boris Johnson were trying to goad his Tory colleagues into ousting him as U.K. Prime Minister, he couldn’t do better than the response his government unveiled Thursday to a cost-of-living crisis. What should have been a chance to reset his embattled administration has become a master class in how not to govern as a conservative.

Household budgets took further knocks Thursday in what is fast becoming an emergency for millions of Britons. The energy regulator announced that starting in April the cap on household energy prices will rise 54%, potentially adding nearly £700 ($950) a year to the average family bill. The Bank of England, meanwhile, raised its benchmark interest rate another quarter-percentage point to 0.5%, following an increase in December.

The central bank estimates consumer-price inflation will exceed 7% this spring, and it can only hope its monetary tightening will control price rises after that. As a result of this inflation and projected tax increases, the average household’s inflation-adjusted post-tax disposable income will fall 2% over the year.

The potential political fallout should be triggering a major rethink in Mr. Johnson’s administration. His subsidies for renewables have boosted energy bills even as the global market pushes natural-gas prices higher. Households will get a double tax whammy when the new accounting year starts in April, as Mr. Johnson pushes ahead with a 2.5% payroll-tax increase and inflation drags more households’ nominal earnings into higher tax brackets.

Instead, Mr. Johnson is doubling down on his worst instincts. Chancellor Rishi Sunak on Thursday unveiled a complex web of subsidies to ameliorate energy bills. This includes a one-time rebate of £150 on local-government taxes for 80% of households. Mr. Sunak also will offer a one-time £200 discount on every household’s energy bill in October—which household will then “repay” in £40 increments over five years.

The one thing Mr. Johnson refuses to do is to cut the taxes that are eroding incomes. He has ruled out canceling the payroll-tax rise, apparently at Mr. Sunak’s insistence. The government also refuses to reduce the 5% value-added tax (VAT) on household energy, despite Mr. Johnson having promised in 2016 that eliminating this tax would be a major benefit of Britain’s departure from the European Union.

Mr. Johnson’s brand of big-government conservatism explains why he can’t or won’t act decisively on living costs. He promised to spend an extra £12 billion a year on the government-run National Health Service and he needs the payroll-tax income to do it. He also persuaded himself that a VAT cut on energy would help too many high-income households. Never mind that consumption taxes are highly regressive—and Mr. Sunak’s scattershot tax rebate will also benefit many higher-income households.

A simpler plan to cut taxes across the board and ditch costly green subsidies would have helped. Mr. Johnson’s big-government conservatism has produced policies that voters don’t understand, let alone like. The Prime Minister is facing a scandal over parties his staff held during the pandemic lockdown, but the bigger threat to his political future is his inability to get a grip on the cost-of-living mess he has done so much to make worse.